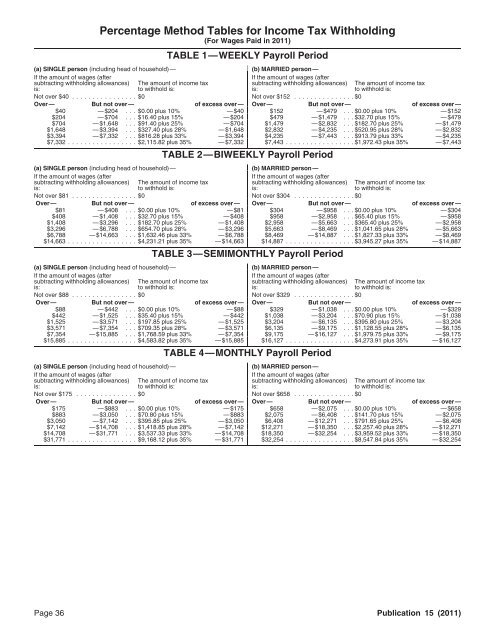

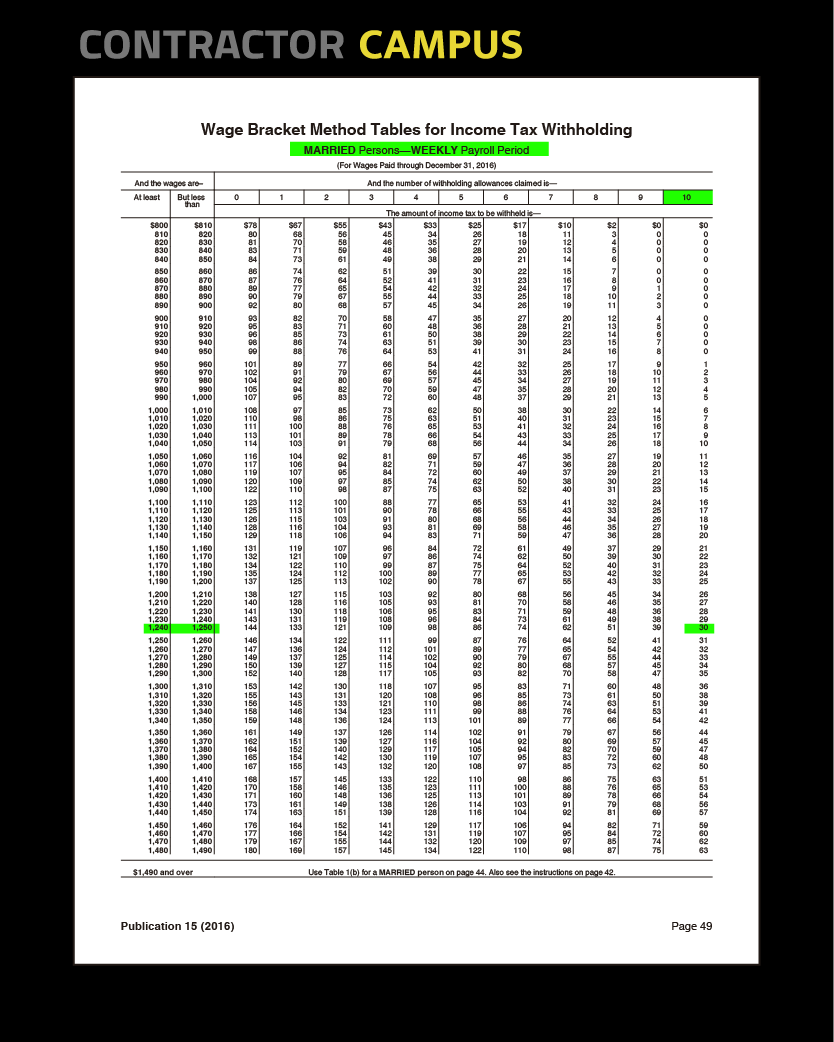

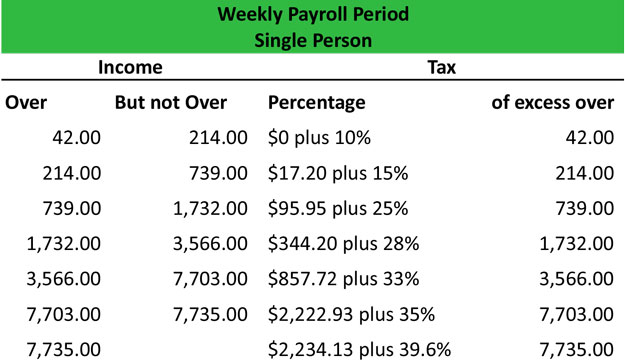

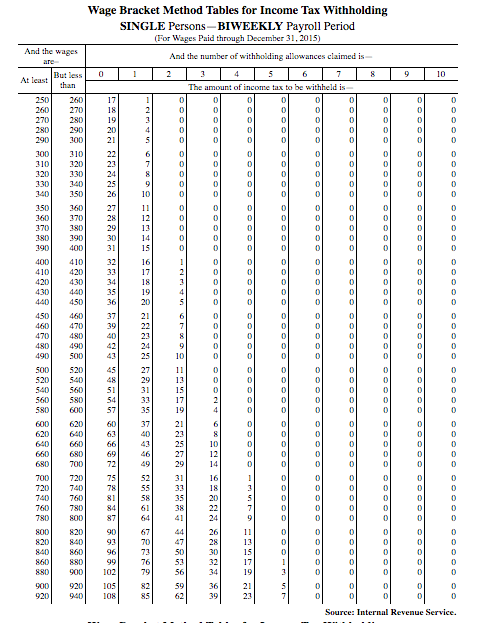

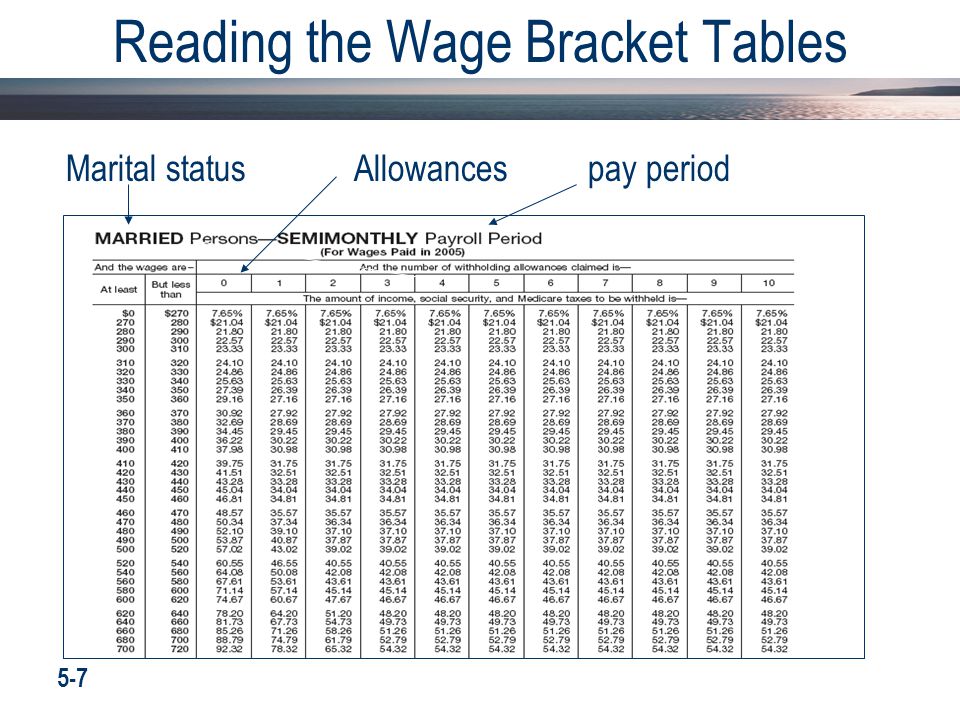

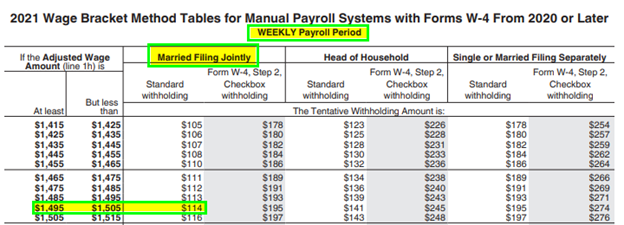

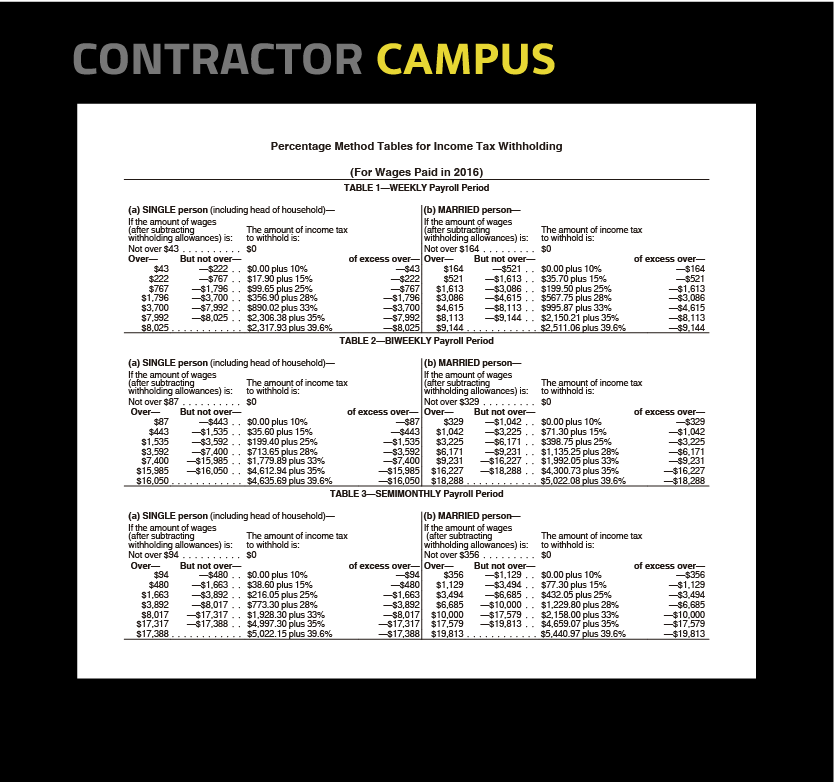

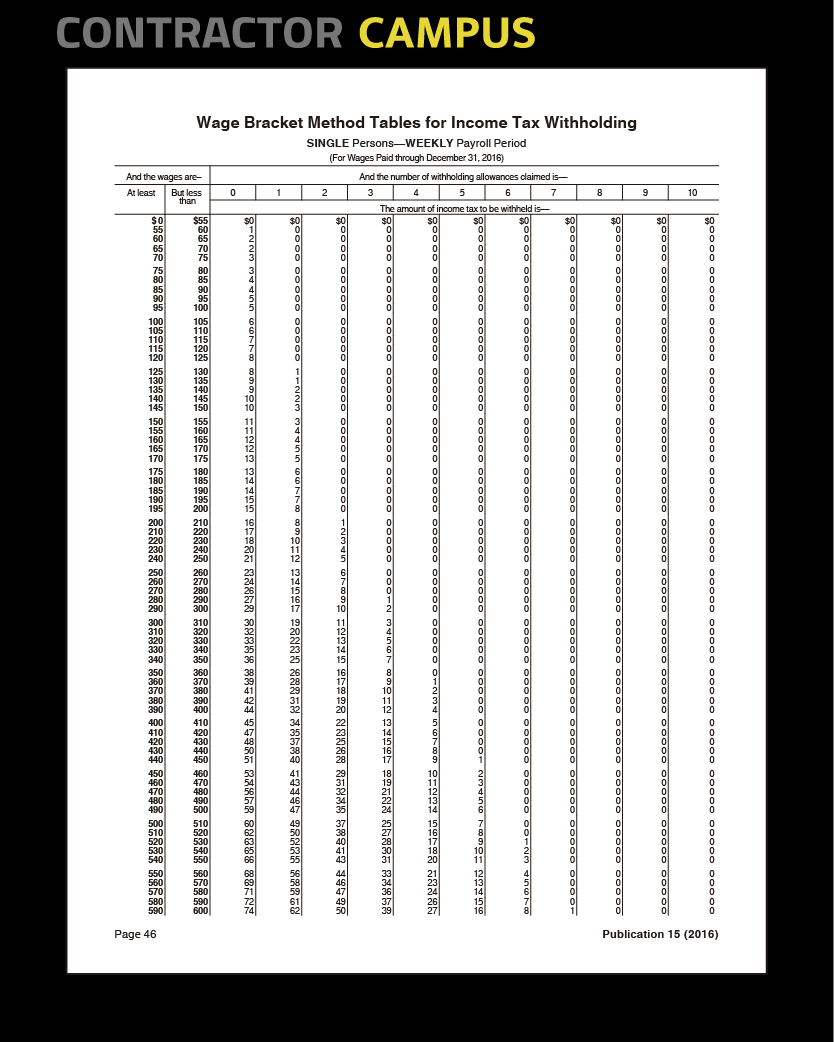

Publication 15: Circular E, Employer's Tax Guide; Chapter 16 How To Use the Income Tax Withholding & Advance Earned Income Credit (EIC) Payment Tables

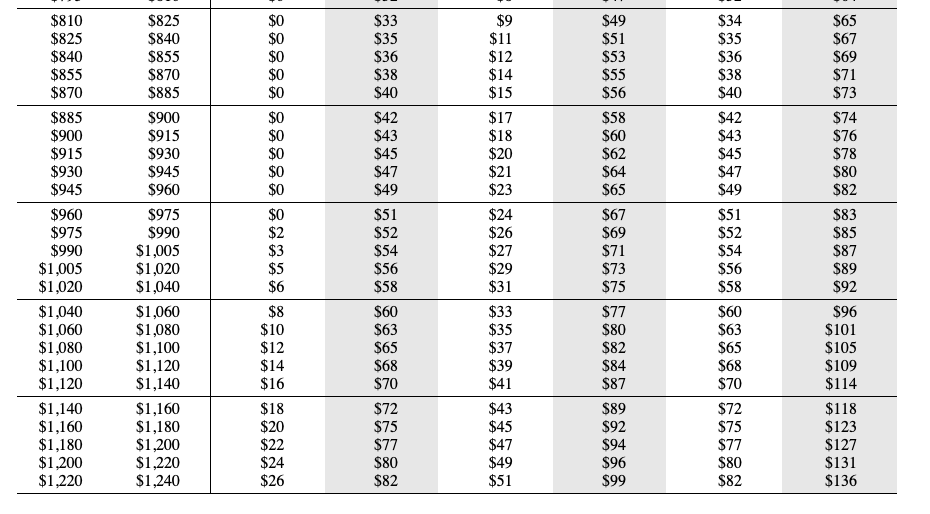

united states - Computing federal withholding for wife's W4 for new job, and if I need to adjust mine? - Personal Finance & Money Stack Exchange

)